The Zacks Accident and Well being Insurance coverage business is predicted to journey on the rise in underwriting publicity. Aflac Included AFL, Unum Group UNM, Trupanions TRUP, Employers Holdings EIG and AMERISAFE AMSF ought to proceed benefiting from prudent underwriting requirements. Nevertheless, an increase in claims frequency may weigh on the positives.

The business has been witnessing smooth pricing over the previous a number of quarters, which isn’t anticipated to alter any time quickly. Nonetheless, an increase in claims, with enterprise actions returning to regular ranges, is prone to improve pricing for this business within the coming days. Additionally, the growing adoption of know-how in operations will assist in the graceful functioning of the business amid coronavirus-induced challenges.

In regards to the Business

The Zacks Accident and Well being Insurance coverage business includes corporations that present staff’ compensation insurance coverage, partially to employers working in hazardous industries. These gamers supply group, particular person or voluntary supplemental insurance coverage merchandise. Employees’ compensation is a type of accident insurance coverage paid by employers with out affecting staff’ pay. Claims are typically met by insurance coverage corporations or state-run staff’ compensation funds, benefiting each employers and staff. Whereas it boosts staff’ morale, thus, productiveness, employers stand to profit from decrease claims prices. As consciousness about the advantages of getting such protection rises, the way forward for these insurers appears vivid. Per stories revealed in IBISWorld, the US staff’ compensation insurance coverage business is estimated to develop 3% to $48.3 billion in 2022 based mostly on revenues.

3 Developments Shaping the Way forward for the Accident & Well being Insurance coverage Business

Pricing Strain to Proceed: The employee compensation business has been witnessing pricing stress over the previous a number of quarters. Given this smooth pricing, efforts to retain market share will once more induce pricing stress, which could curb top-line progress. Per Willis Towers Watson’s Business Traces Insurance coverage Pricing Survey, staff’ compensation witnessed a slight value discount in 2021. Per the survey, pricing at staff’ compensation might be down 2% to up 4% in 2022. With business and industrial actions again on monitor , the demand for insurance coverage protection is prone to be on the rise. SpendEdge estimates staff compensation insurance coverage pricing to extend at a five-year (2022-2026) CAGR of 5.25%.

Claims Frequency May Rise: The accident and medical insurance area has witnessed progress through the years, primarily pushed by a rise in advantages supplied by employers. The correct of staff’ compensation coverage interprets into private look after injured staff, elevated productiveness, larger worker morale, decrease turnover, lowered claims prices and fewer monetary fear amid rising medical prices. Rising underwriting publicity, sustained lower in claims frequency charges attributable to a greater working surroundings and conservative reserve ranges have been boosting the business’s efficiency. Per The US Bureau of Labor Statistics knowledge in an AmTrust Monetary report, staff over the age of 55 will improve to about 25% in 2024 from 21.7% in 2014. Thus, claims may rise based mostly on the magnitude of severity, the report states. Additionally, with enterprise actions getting regular, claims might rise.

Rising Adoption of Expertise: The business is witnessing the accelerated adoption of know-how in operations. Telemedicine has gained tempo amidst the pandemic. Carriers began promoting insurance policies on-line that appealed to the tech-savvy inhabitants. Given the present pandemic, a number of organizations are working remotely to adjust to social distancing norms. Digital purposes, e-signatures, digital coverage supply, cloud computing and blockchain ought to assist insurers achieve a aggressive edge. Nonetheless, larger spending on technological developments will lead to escalated expense ratios.

Zacks Business Rank Signifies Vibrant Prospects

The group’s Zacks Business Rank, which is principally the common of the Zacks Rank of all member shares, signifies encouraging near-term prospects. The Zacks Accident and Well being Insurance coverage business, housed throughout the broader Zacks Finance sector, presently carries a Zacks Business Rank #19, which locations it within the high 8% of the 250 plus Zacks industries. Our analysis reveals that the highest 50% of the Zacks-ranked industries outperform the underside 50% by an element of greater than 2 to 1.

The business’s place within the high 50% of the Zacks-ranked industries is a results of a constructive earnings outlook for the constituent corporations in combination. Trying on the combination earnings estimate revisions, it seems that analysts are step by step gaining confidence on this group’s earnings progress potential. The business’s earnings estimate for the present yr has moved up 3.9% in a yr.

We current a couple of shares one can purchase or retain, given their enterprise development endeavors. However earlier than that it is price having a look on the business’s efficiency and present valuation.

Business Outperforms Sector and S&P 500

The Accident and Well being Insurance coverage business has outperformed each the Zacks S&P 500 composite and its personal sector over the previous yr. The shares on this business have collectively gained 16.1% prior to now yr towards the Finance sector’s decline of 12.4% and the Zacks S&P 500 composite’s lower of 18.1% over the identical interval.

One-Yr Worth Efficiency

Present Valuations

On the premise of a trailing 12-month price-to-book (P/B), generally used for valuing insurance coverage shares, the business is presently buying and selling at 1.56X in contrast with the Zacks S&P 500 composite’s 5.49X and the sector’s 3.41X.

Over the previous 5 years, the business has traded as excessive as 1.6X, as little as 0.58X and on the median of 1.15X.

Worth-to-E-book (P/B) Ratio (TTM)

Worth-to-E-book (P/B) Ratio (TTM)

5 Accident & Well being Insurance coverage Shares to Hold an Eye on

We’re presenting one Zacks Rank #1 (Sturdy Purchase) inventory, one Zacks Rank #2 (Purchase) inventory and three Zacks Rank #3 (Maintain) shares from the Zacks Accident and Well being Insurance coverage business. You possibly can see the entire listing of in the present day’s Zacks #1 Rank shares right here.

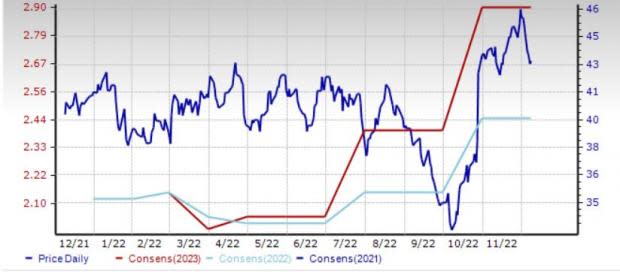

Employers Holdings: This Reno, NV-based supplier of staff’ compensation insurance coverage to small companies within the low-to-medium hazard industries carries a Zacks Rank #1. EIG ought to proceed to profit from a stable presence in enticing markets and prudent underwriting. It carries a VGM Rating of B.

Employers Holdings delivered a trailing four-quarter earnings shock of 25.31% on common. The Zacks Consensus Estimate for 2022 and 2023 backside line has moved 14% and 20.8% prior to now 60 days. The consensus estimate for 2022 and 2023 signifies a 3.5% and 18.4% year-over-year improve, respectively. The inventory has gained 8.3% in a yr.

Worth and Consensus: EIG

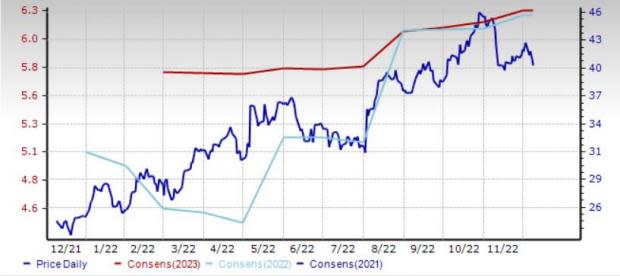

Unum Group: Chattanooga, TN-based Unum Group supplies long-term care insurance coverage, life insurance coverage, employer- and employee-paid group advantages and associated companies. The continued rollout of dental merchandise and geographic enlargement have been paying off because the acquired dental insurance coverage companies are rising in the US and the UK. This Zacks Rank #2 insurer has a formidable VGM Rating of B.

The anticipated long-term earnings progress price for Unum Group is 12.2%, higher than the business common of 8.6%. The Zacks Consensus Estimate for 2022 and 2023 earnings signifies a year-over-year improve of 43.5% and 0.6%, respectively. UNM delivered a trailing four-quarter earnings shock of 34.9% on common. The consensus estimate for 2022 and 2023 has moved 1.8% north prior to now 60 days, respectively, reflecting analysts’ optimism. The inventory has risen 67.8% in a yr.

Worth and Consensus: UNM

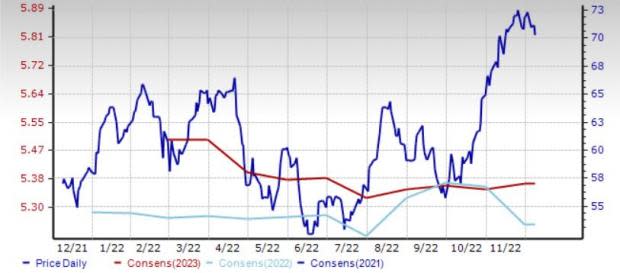

Aflac Included: This Columbus, GA-based firm presents voluntary supplemental well being and life insurance coverage merchandise and operates via Aflac Japan and Aflac US Aflac’s Argus buyout will present it with a platform to construct the corporate’s community of dental and imaginative and prescient merchandise and additional strengthen its US phase.

The AFL delivered a trailing four-quarter earnings shock of 4.8% on common. The anticipated long-term earnings progress price is pegged at 5%. The Zacks Consensus Estimate for 2023 signifies a 2.3% year-over-year improve. The inventory has gained 22.6% in a yr. Aflac carries a Zacks Rank #3.

Worth and Consensus: AFL

amerisafe: DeRidder, LA-based Amerisafe is a specialty supplier of staff’ compensation insurance coverage. AMSF ought to proceed to realize from its high-hazard area of interest focus, small to mid-size employer focus, high-hazard underwriting experience and intensive claims administration. A stability sheet with no debt supplies Amerisafe loads of monetary flexibility to fund operations, meet monetary obligations and climate shocks or surprising bills.

The Zacks Consensus Estimate for 2022 signifies a 2.1% year-over-year improve and has moved 7.5% north prior to now 60 days. Amerisafe carries a Zacks Rank #3. The inventory has misplaced 2.1% in a yr.

Worth and Consensus: AMSF

Trupanions: This Seattle, WA-based pet insurer supplies medical insurance coverage for cats and canines on a month-to-month subscription foundation in the US, Canada, and Puerto Rico. This Zacks Rank #3 pet insurer is effectively poised to profit from a big however underpenetrated addressable market of $34.1 billion, banking on the energy of its product portfolio, which drives retention ratio, worldwide enlargement and continued strategic investments.

The Zacks Consensus Estimate for 2023 signifies a 21.2% year-over-year improve. TRUP delivered a trailing four-quarter earnings shock of twenty-two.76% on common and has a Progress Rating of B. The inventory has misplaced 65.9% in a yr.

Worth and Consensus: TRUP

Need the most recent suggestions from Zacks Funding Analysis? At this time, you’ll be able to obtain the 7 Finest Shares for the Subsequent 30 Days. Click on to get this free report

Aflac Included (AFL) : Free Inventory Evaluation Report

Unum Group (UNM): Free Inventory Evaluation Report

AMERISAFE, Inc. (AMSF) : Free Inventory Evaluation Report

Employers Holdings Inc (EIG) : Free Inventory Evaluation Report

Trupanion, Inc. (TRUP) : Free Inventory Evaluation Report

To learn this text on Zacks.com click on right here.

Zacks Funding Analysis